Mortgage Calculator Estimate Monthly Mortgage Payments

Table Of Content

Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Another strategy for paying off the mortgage earlier involves biweekly payments.

How to calculate amortization with an extra payment

If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. Use the mortgage calculator to get an estimate of your monthly mortgage payments. When you make your monthly mortgage payment, part of your payment will go toward interest and the rest will be applied to the principal. In the beginning, most of your monthly payments will go toward interest.

How to find the best mortgage rates

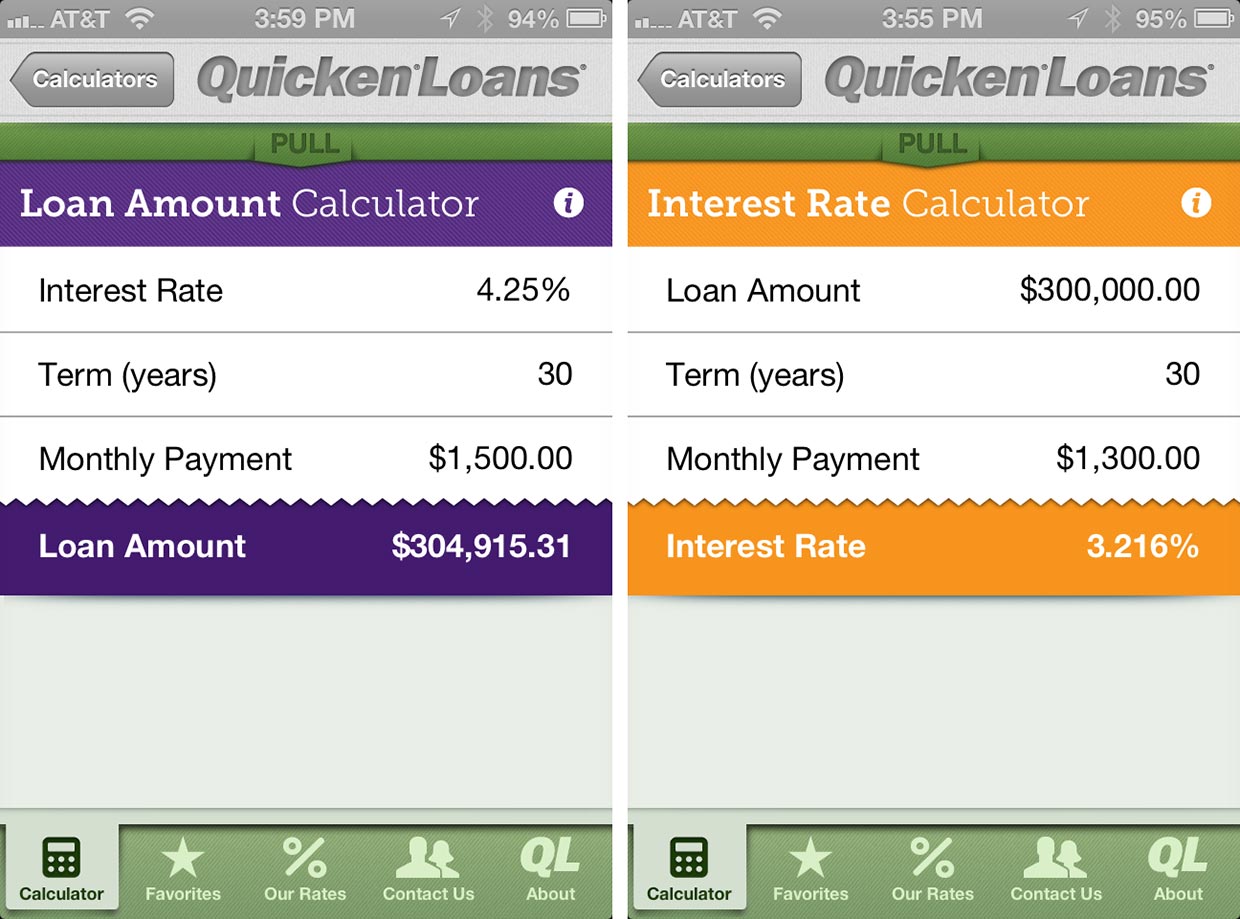

Department of Veterans Affairs funding fee and closing costs page. This calculator figures monthly mortgage payments based on the principal borrowed, the length of the loan and the annual interest rate. It also computes your total mortgage payment inclusive of property tax, property insurance and PMI payments (monthly PITI payments). Once you have calculated payments, click on the "Create Amortization Schedule" button to create a report you can print out. A 30-year fixed-rate mortgage is the most common type of mortgage. However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years.

Rocket Mortgage

But some courses have popped up online which cost more than £1,000. "It's happened on so many occasions, like four, five times," he said. Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid. Some intangible assets, with goodwill being the most common example, that have indefinite useful lives or are "self-created" may not be legally amortized for tax purposes. Writers and editors and produce editorial content with the objective to provide accurate and unbiased information.

This calculator doesn’t include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose. If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time. For example, you may have homeowners association dues built into your monthly payment. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up.

Mortgage increase calculator: how much has yours risen in 2024? - The Telegraph

Mortgage increase calculator: how much has yours risen in 2024?.

Posted: Wed, 17 Apr 2024 07:00:00 GMT [source]

Mortgage Payoff Calculator - Ramsey - Ramsey Solutions

Mortgage Payoff Calculator - Ramsey.

Posted: Wed, 10 Mar 2021 22:43:09 GMT [source]

If you don’t have high enough equity in the home, you’re considered a possible default liability. In simpler terms, you represent more risk to your lender when you don’t pay for enough of the home. The first two options, as their name indicates, are fixed-rate loans. This means your interest rate and monthly payments stay the same over the course of the entire loan. Many mortgage lenders generally expect a 20% down payment for a conventional loan with no private mortgage insurance (PMI).

Honestly, the situation is so bleak, people may need to consider other countries. Certain businesses sometimes purchase expensive items that are used for long periods of time that are classified as investments. Items that are commonly amortized for the purpose of spreading costs include machinery, buildings, and equipment. Although it can technically be considered amortizing, this is usually referred to as the depreciation expense of an asset amortized over its expected lifetime.

Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures.

Conventional loans are mortgages that are not federally backed by the government. They make up around two-thirds of mortgages used by homebuyers in America. Conventional loans are provided by private lenders such as banks, non-bank mortgage companies, and credit unions.

And you can tweak things like the home price or loan terms to find the best mortgage options for your budget. If you only consider the price of your home, you’re missing out on a big part of the financial picture. When you figure out your total monthly household income, be sure to consider any recurring debt and expenses. This is the amount you borrow from your lender to buy your home.

Your lender will then re-evaluate your credit history and financial situation. A mortgage is a loan to help you cover the cost of buying a home. To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier.

As long as you make consistent payments, your debt should be paid off within 30 years.On the other hand, adjustable-rate mortgages are loan options with an introductory rate. It starts off with a low interest rate during the introductory period, after which the rates adjusts every year according to the market index. ARMs come in different terms, such as 3/1 ARM, 5/1 ARM, 7/1 ARM, and 10/1 ARM. Amortization is the process of gradually paying off a debt through a series of fixed, periodic payments over an agreed upon term. The payment consists of both interest on the debt and the principal on the loan borrowed.

Gradually, you’ll pay more and more principal and less interest. Additionally, some lenders have programs offering mortgages with down payments as low as 3% to 5%. The table below shows how the size of your down payment will affect your monthly mortgage payment. One of the rules you may hear as a homebuyer is the 28/36 rule or the debt-to-income (DTI) rule. This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt.

Private parking businesses have been accused of using misleading and confusing signs, aggressive debt collection and unreasonable fees. Her charity has also been affected by those increased costs, with the electricity bill rising to £10,000 a month at their highest, to fund things like heated pools for alligators. The next Bank of England decision on rates comes on 9 May - and pretty much no one is expecting a cut from the 16-year high of 5.25% at that stage. There are also national insurance cuts for the self-employed. This includes the scrapping of Class 2 contributions, as well as a reduction of the rate of Class 4 contributions from 9% to 6% for the £12,570 to £50,270 earnings bracket. When I asked the now-psychic where the £2,000 actually came from, he said it was payment for a modelling job he had been offered.

Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment.

Comments

Post a Comment